What is KYC?

KYC stands for Know Your Customer, which is a process of verifying the identity of a user by requesting personal information.

The requirement for customers to undergo mandatory verification is primarily driven by the need to confirm their authenticity and prevent fraud. This ensures the safety of both companies and users while adhering to all legal norms.

When deciding to implement KYC verification, companies need to choose reliable methods and tools that combine a high level of security with convenience of use. Blockchain technology is an excellent tool for protecting personal data.

Blockchain technology enables storing user information in the cloud, providing guarantees for the authenticity and security of stored data.

In this article, we will explore how blockchain technology can optimize KYC verification, as well as discuss the advantages of using blockchain in the KYC process with examples from other companies.

- Traditional KYC Systems

- What Does KYC on the Blockchain Look Like?

- Benefits of Using KYC Systems on the Blockchain

- Examples of Companies Using Blockchain Technology in KYC Verification

- Expertise from Brivian

- The Range of Our Services within Blockchain-Based KYC Verification

- Conclusion

Traditional KYC Systems

What is KYC? If we break down the abbreviation KYC, it stands for “Know Your Customer,” which refers to the process of identifying and verifying the identity of a customer without requiring personal contact. This procedure helps reduce the risk of fraud and enhances the reliability of customer data verification.The traditional KYC procedure consists of several stages that allow organizations to ensure the authenticity of their customers’ identities. The key stages of the KYC process include:

1. Customer Identification Program (CIP)

Identification involves the customary collection and verification of current customer information. This can range from checking personal documents to, in extreme cases, scanning fingerprints or faces. Financial institutions such as banks often perform this verification during customer registration. Cryptocurrency exchanges and other institutions with more flexible customer requirements may initiate the procedure after registration.2. Customer Due Diligence (CDD)

Sometimes, after verifying the customer’s basic information, a company may decide to conduct additional checks to assess risks and gather more information about the individual. If the customer has been involved in financial fraud or is under investigation, such information is likely to surface.3. Data Monitoring

Organizations update customer information as needed and store it in compliance with data storage requirements. This enables the system to carefully analyze suspicious transactions.This procedure also allows for tracking large transactions to undesirable countries. Depending on the investigation results, a company or exchange may suspend an account and report the issue to regulatory and law enforcement agencies.

However, the introduction of KYC systems has brought about a new challenge: the verification process has become a lengthy and protracted stage in personal data checks, and its transparency is questionable. Each identity verification from scratch requires not only time but also financial investment. Moreover, this approach poses security risks to the customer since personal data is transmitted from the user to the server during each verification, increasing the risk of data leakage.

If you require specialists to optimize your company’s business processes, please contact us.

What Does KYC on the Blockchain Look Like?

To mitigate risks associated with KYC systems, many companies have found a solution by leveraging blockchain technology. The use of blockchain technology in user verification ensures a more secure and efficient authentication of customers.The architecture of blockchain itself involves Distributed Ledger Technology (DLT), which allows for the collection of information from various organizations into a single, cryptographically secured, and immutable database (DB). Such a DB does not require additional verification of the information’s authenticity.

Experts at Brivian have explored the possibility of creating a unified system where users do not have to undergo the KYC process multiple times. It would suffice for users to complete the KYC procedure only once.

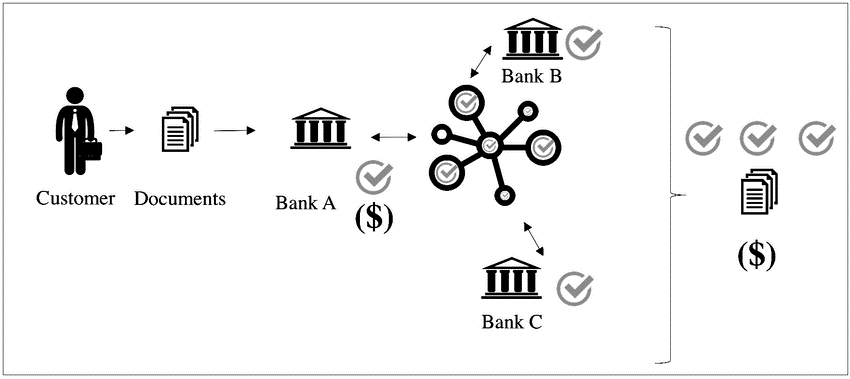

There exists an algorithm for user verification using blockchain. Let’s illustrate how it would work using the example of a financial institution (a bank):

- A customer approaches a bank to apply for a loan and undergoes the KYC process.

- The bank verifies the data and, upon confirmation, sends it to the blockchain platform, which is accessible to other financial organizations and government entities.

- If the user decides to use similar services from another bank, the second bank refers to the cloud-based database and confirms the customer’s identity.

Of course, such a system should take into account the user’s consent, as in this case, their personal data is shared with other organizations connected to the system. To give consent, the user needs to log into the system and, similar to cryptocurrency transactions, use a private key to initiate the information exchange operation.

Of course, such a system should take into account the user’s consent, as in this case, their personal data is shared with other organizations connected to the system. To give consent, the user needs to log into the system and, similar to cryptocurrency transactions, use a private key to initiate the information exchange operation.

❗️ When obtaining user consent, access to the data may also be granted to a third party, such as a bank, but ultimately, the user is considered the owner of this data.

Benefits of Using KYC Systems on the Blockchain

Let’s summarize the advantages of using KYC systems on the blockchain:1. Decentralization

With blockchain technology, customer information is stored and updated on multiple computers distributed across the network. This significantly enhances security as data is not stored in a single central location and cannot be easily altered or tampered with.2. Confidentiality and data protection

KYC systems on the blockchain can employ cryptographic methods to ensure the confidentiality of customers’ personal data. Various mechanisms can be applied, such as encryption, with the purpose of protecting data and enabling access control.3. Speed and efficiency

KYC procedures on the blockchain can be automated and accelerated through the use of smart contracts. Identity verification requests can be processed automatically, minimizing manual procedures and reducing the time required to complete the KYC process.4. Accessibility

KYC systems on the blockchain can provide broader access to organizational services, especially for those located remotely.5. User control over their data:

The possibility of granting access to a special identification card that certifies the successful completion of the procedure and provides control over the data emerges. At the user’s discretion, they can delete their personal data from the blockchain platform.KYC systems on the blockchain offer the potential to enhance security, improve efficiency, and reduce costs in the process of customer identity verification.

As a reminder, the deployment of such systems also requires compliance with regulatory and legislative requirements in the realm of security and data protection.

Examples of Companies Using Blockchain Technology in KYC Verification

The benefits of implementing KYC systems on the blockchain can be seen across various industries beyond banks and other financial institutions. Companies, organizations, and government entities typically have an interest in genuinely knowing who they are interacting with.Areas of application for KYC systems on blockchain technology include:

1. Financial sector

Banks, insurance companies, and payment systems can utilize KYC systems on the blockchain to verify customers and regulate financial transactions.2. Cryptocurrency

Cryptocurrency trading platforms often require KYC verification from users to ensure security and data confidentiality during registration and customer verification.3. Crowdfunding

Crowdfunding platforms can utilize blockchain-based KYC to verify the authenticity of participants.4. International payment networks

Identity verification and confirmation of senders and recipients occur, significantly enhancing transaction security and speeding up the process of fund transfers.5. E-commerce

KYC on the blockchain can be applied in various online domains, including payment gateways, digital platforms, and services that require user registration and identity verification.This article may also be interesting for you:

How to Сreate an E-Commerce App Like EBay: Tips and Trends

These are just a few examples of the industries where KYC on the blockchain can be applied. In general, blockchain technology can be utilized in almost any sector where authenticity verification of customer data is required.Now, let’s provide 4 specific examples of companies successfully using KYC on the blockchain:

- SecureKey and IBM collaborate on developing a blockchain-based digital identity system. The system aims to simplify the customer recognition process for accessing services such as opening bank accounts, obtaining driver’s licenses, and paying utility bills.

- Hyperledger Fabric is used for document exchange, delivery information, and payments in a unified registry, optimizing the process of partner identification and reducing transaction time and document duplication.

- SAP has employed blockchain to streamline bureaucratic processes, creating a blockchain-based database that allows for quick retrieval of information about all residents of Italy.

- PBA (Private Banking Association) brings together 31 banks, including international financial institutions like Industrial and Commercial Bank of China, Citibank, Deutsche Bank, and others. The new blockchain platform will be used by all association members, applying standardized protocols for processing and exchanging customer data through a decentralized self-regulating network.

Expertise from Brivian

We present to you the expert opinion on the use of KYC systems on the blockchain from the Head of Web Application Development at Brivian:“First and foremost, integrating KYC systems with blockchain technology automates complex verification processes. This reduces the reliance on human factors and mitigates the risk of fraud. How does this work in practice? The system can independently notify both clients and the company about attempts to violate rules or DoS attacks on the platform. In the financial sector, for example, automation can be implemented to address regular challenges such as risk assessment processes conducted by banks and insurers.”

The Range of Our Services within Blockchain-Based KYC Verification

At Brivian, our specialists adopt an integrated approach to KYC verification, leveraging blockchain technology. Here is a list of services we provide in this area:1. Application development

We develop applications from scratch, integrating a KYC system that connects to a cloud-based database.2. Application customization

We modify existing applications, integrating blockchain-based KYC systems.3. Tailored solutions

We offer individualized solutions to optimize IT products by utilizing blockchain technology in user verification.4. Support

We provide end-to-end product launch support, offering technical assistance regarding security within corporate or industrial networks.To request our services, you can get in touch with us.

Conclusion

The use of KYC on the blockchain is highly beneficial for both companies and clients. By implementing this approach, the level of trust among participants in business processes increases, the need for repeated identity verification is eliminated, instances of fraud are reduced, and reporting processes become more efficient. Furthermore, a system based on a decentralized distributed ledger eliminates the possibility of industry monopolies. The immutability of blockchain-recorded data and the open-source nature ensure equal rules of the game for all participants.You may also be interested in the other articles about Blockchain.

If your application or website requires the integration of a blockchain-based KYC system, please contact us.

Thank you for your attention!