People are constantly ordering things and services online. And in order to pay for all this, an application or a website must have a payment gateway integration — no one will send you money by mail or transfer it to your personal bank account. Payment gateways help to provide secure and fast payments. Thanks to them, users order thousands of products from Amazon or eBay. We are a mobile app development company and we’re here to share our experience on this topic. How mobile app payment gateways work, how to choose the right one and integrate it into an iOS or Android application — figure it out in this article.

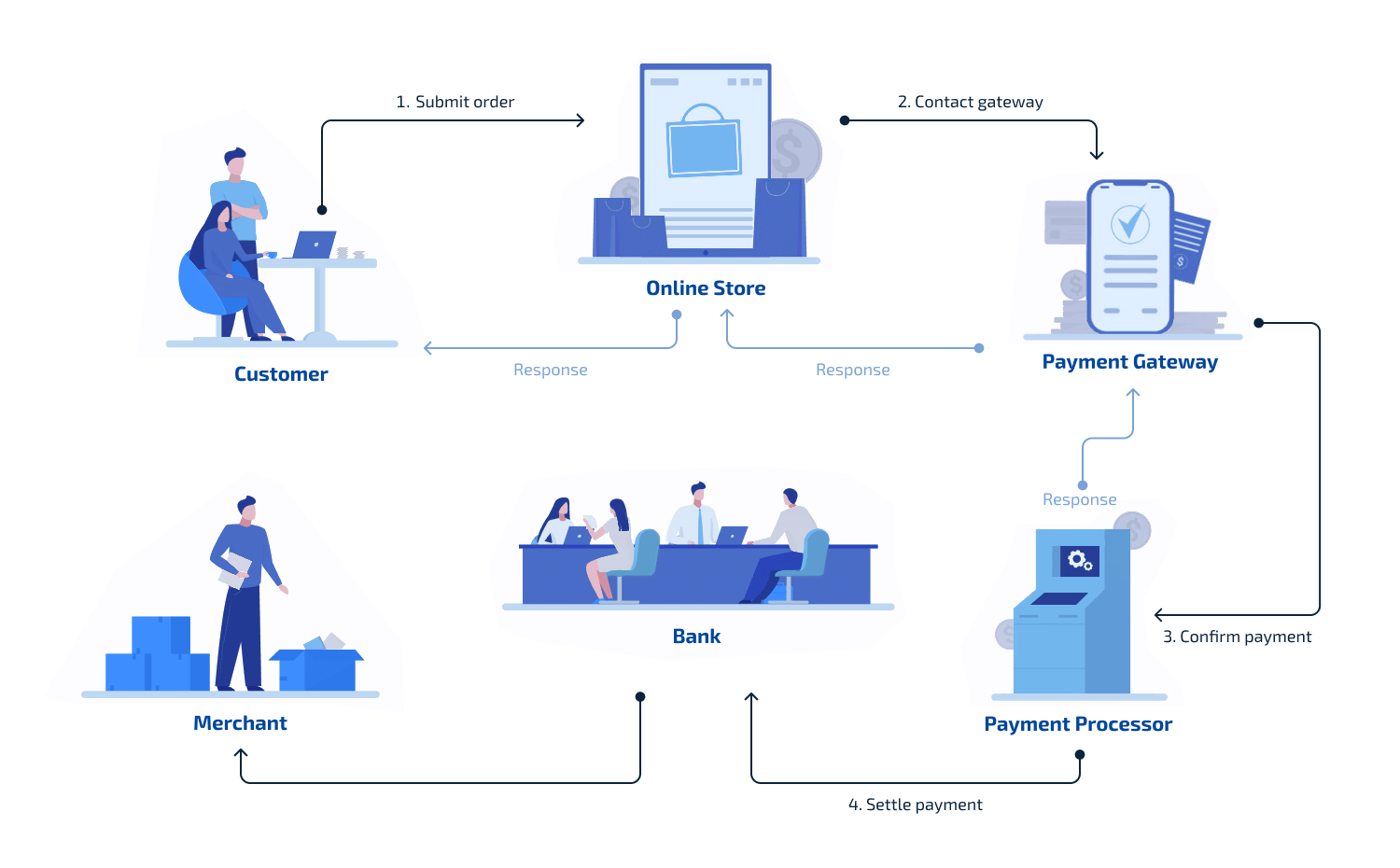

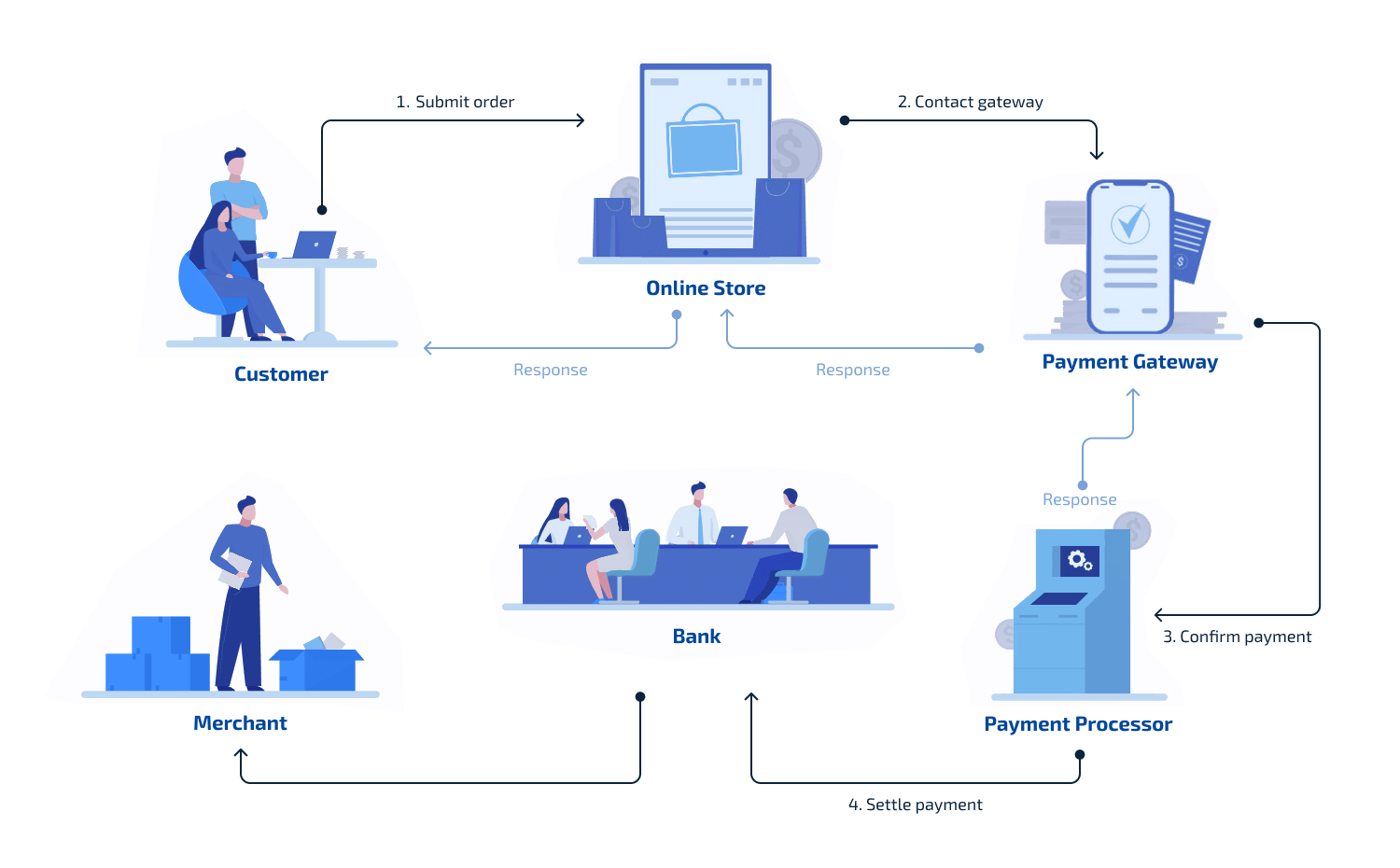

The process looks like this:

Payflow also has some disadvantages — it saves the payment information of buyers, which means that if you decide to change the gateway to a new one, you won’t be able to transfer your clients’’ data to it. Because of this, when you change the gateway, you will have to re-request data from your regular clients. Another disadvantage is that Payflow is available only in four countries — the USA, Canada, Australia, and New Zealand. If your business is registered elsewhere, you won’t be able to integrate with Payflow.

Amazon Pay is available for sellers with businesses registered in the USA, UK, Austria, Belgium, Cyprus, Denmark, France, Germany, Hungary, Ireland, Italy, Japan, Luxembourg, the Netherlands, Portugal, Spain, Sweden and Switzerland.

Stripe also has a list of restricted businesses including investment and credit services, gambling, adult content and services, pyramid schemes, telemarketing, bankruptcy attorneys, and many others. They have a detailed explanation on the “Restricted Businesses” page. Before choosing a gateway, you should be sure you’re on the white list of the payment gateway provider.

What is a payment gateway?

To put it simply, a payment gateway is a connecting link between a buyer and a seller of an online store. It allows users to enter card data safely, and to conduct financial transactions without unnecessary problems.What’s the difference between payment gateways and payment systems?

Unlike a payment system, a gateway doesn’t interact with money. It’s only responsible for transmitting data to banks, and a payment system is used for processing payments. Although some companies combine these services into a single system. For example, Paypal is a payment system, and it allows to transmit the data securely at the same time.How do mobile app payment gateways work?

So, the buyer only shares their billing information with a payment gateway. Eventually, the money goes to the seller’s bank account, which occurs without the participation of the payment gateway. The gateway just informs the buyer about the results. But what exactly happens and why is it safe?The process looks like this:

The process of mobile app payment gateways work.

- A user clicks the “purchase” button.

- They enter their bank card details on the payment page.

- The payment gateway encrypts user data and sends it to a payment processor

- The processor verifies if the data is correct and sends it to the bank.

- Then, this request should pass verification.

- The processor sends feedback from the bank to the gateway.

- After the user’s approval, the money gets withdrawn from their card and sent to the seller’s account.

Why does any online business need a payment gateway integration?

A payment gateway is a must-have for any application that needs payments. Without this integration, the payment process will be a complex and long operation, which will annoy users. Or this operation will be unsafe, and if user data falls into the hands of scammers, they won’t thank you for it. Let’s see what is so good about payment gateway integration.- Secure payments. Gateways are the most effective way to protect user data and earn their trust. Payment gateways have built-in fraud detection tools. They encrypt data, transmit it through secure channels, and send authorization requests.

- Fast transactions. Payment gateways allow users to make instant payments. Without them, each purchase would take much longer — which means that the buyer is unlikely to return to the store to buy another product. They will just go to another online store. Thus, the payment gateway also helps you to compete in the market.

- Vast audience. Payment gateways eliminate any boundaries between your company and buyers from other countries. Instead of opening a branch of your company abroad, you can develop an application with a payment gateway and sell your products worldwide.

- 24/7 support. Payment gateways ensure that your online store is open at any time of the day and available from anywhere in the world. Your managers don’t need to process payments at 2 a.m., and customers don’t need to wait for managers to call them and confirm the purchase.

- No need to control transactions. The transaction gets approved or rejected in a matter of seconds, so again, you don’t need to control this process. If the payment is rejected, or the buyer wants to return the funds, your manager doesn’t take part in this process. Everything happens on the side of the payment system.

How to choose a proper mobile app payment gateway?

Each payment gateway has its own characteristics. Some of them support a large number of currencies, some accept cryptocurrencies, some work only in certain countries. Since everything depends on your business needs, you need to define your goals, compare different payment gateways and choose the most appropriate option, then you can request app development services. Here’s a list of the most popular payment gateways, and some facts that will help you choose the right one.🔴 PayPal

PayPal is one of the most popular and trusted payment platforms in e-commerce. PayPal offers a secure and open payment gateway called Payflow to businesses. Using the gateway’s APIs, sellers can process debit and credit card payments, authorizations, credit voids, and more. PayPal also offers Payments Pro, which sellers can use as a credit card processor. As for Payflow, sellers need to use a third-party payment processor, bank, or card association to process their payments. Payflow integrates with almost any payment processor and shopping cart solution. Sellers can accept payments in 25 different currencies, and all major bank cards including Visa, Mastercard, American Express, Discover, JCB, and Diner’s Club.Payflow also has some disadvantages — it saves the payment information of buyers, which means that if you decide to change the gateway to a new one, you won’t be able to transfer your clients’’ data to it. Because of this, when you change the gateway, you will have to re-request data from your regular clients. Another disadvantage is that Payflow is available only in four countries — the USA, Canada, Australia, and New Zealand. If your business is registered elsewhere, you won’t be able to integrate with Payflow.

🔴 Amazon Pay

Amazon Pay is a simple, fast and secure payment gateway for Amazon’s clients. The service is intended for both sellers and buyers. Amazon Pay accepts payments from Visa, Mastercard, Discover, American Express, Diner’s Club, and JCB cards. In addition, buyers have the opportunity to make purchases using Alexa.Amazon Pay is available for sellers with businesses registered in the USA, UK, Austria, Belgium, Cyprus, Denmark, France, Germany, Hungary, Ireland, Italy, Japan, Luxembourg, the Netherlands, Portugal, Spain, Sweden and Switzerland.

🔴 Stripe

This cloud payment platform is a universal solution for managing, processing, and accepting payments. Stripe supports card brands like Visa, Mastercard, American Express, Discover, Diner’s Club, JCB, China UnionPay, Cartes Bancaires, and Interac. Stripe works with a big variety of countries — you can check if your country is on the list here.Stripe also has a list of restricted businesses including investment and credit services, gambling, adult content and services, pyramid schemes, telemarketing, bankruptcy attorneys, and many others. They have a detailed explanation on the “Restricted Businesses” page. Before choosing a gateway, you should be sure you’re on the white list of the payment gateway provider.

🔴 Braintree

Braintree is a payment gateway that belongs to the PayPal network. It offers commercial tools for making a business global, accepting payments and providing commerce for its users. It has features that help companies scale their business around the world. Braintree operates in 45 countries and supports 130 currencies. Sellers in the USA can use Braintree to accept PayPal, Apple Pay, Google Pay, Venmo, and bank cards, including Visa, Mastercard, American Express, Discover, JCB, Diner’s Club, and UnionPay. The company also has a list of restricted activities that you should check before making a choice.🔴 Square

Square Payments is an online payment processing solution that integrates with Square equipment and POS systems. It allows sellers to accept various types of payments, make transactions from anywhere, take payments from all major bank cards, send invoices, store payment details for regular clients, and much more. Currently, sellers can accept payments in the USA, Canada, Australia, Japan, the United Kingdom, Republic of Ireland, France and Spain.How to conduct a payment gateway integration in iOS and Android apps?

To integrate a payment gateway into a mobile application, you need to have programming skills, know the policies of different payment gateway providers, their restrictions, and know in which countries a particular gateway operates. If you are just doing business and don’t want to delve into programming, it’s better to contact a mobile app development company. In any case, to integrate a payment gateway into an iOS or Android application, you need to take these things into account:⚫️ Integrating SDKs

Regardless of which payment gateway you decide to choose, each has its own SDK – software development kit. Software developers take them from the official payment gateway platform and use them for integration. This data is used to collect, store, and process all payment information.⚫️ Using APIs

APIs in the integration of payment gateways facilitate the process of managing bank card payments, making the transactions between the seller and the buyer easier and safer.⚫️ Security certifications

Payment gateways create a highly secure environment that allows sellers and buyers to exchange payment information securely. However, to increase the level of security, you can ask your app development services provider to install additional certificates that comply with the PCI DSS standard (Payment Card Industry Data Security Standard). SSL (Secure Sockets Layer) protects confidential information of all the users.Final thoughts

If you are planning to create a mobile application with a payment function, whether it’s an e-commerce, marketplace or SaaS one, you need a payment gateway integration. This way, you can safely exchange payment information with users and earn their trust. The payment gateway integration will become a competitive advantage since you will make all transactions last several seconds instead of days. To integrate a payment gateway in an iOS or Android application, you need to know programming or request a mobile app development company.At Brivian, we provide app development services and have extensive experience in integrating different payment gateways in applications. Fill in the form below the article or here, and we’ll get back to you to discuss your project.